Find Property

Please provide your search criteria and click the Search button. Review the Help section below for more information on how to locate your Assessment or Fee Parcel.

Help

Assessment

To view a "specific" assessment, please enter the assessment number. This feature may not display all outstanding assessments. If you would like a summary of outstanding assessments, use the FEE PARCEL search.

Fee Parcel

To view a "summary" of all current or delinquent fiscal year assessments outstanding or paid during the current fiscal year, please enter the fee parcel number. If you do not have your assessment or fee parcel number, please contact our office

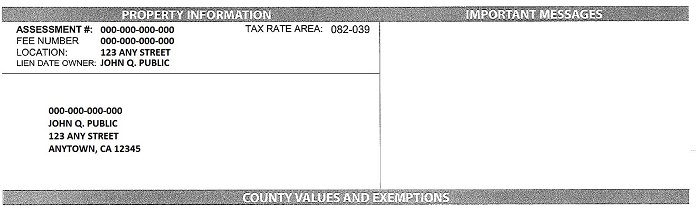

This information is located on the upper left corner of your property tax bill as shown below.

Street Address

You may have difficulty searching for your tax bill because your address on the deed may have been recorded with abbreviations.

Try entering the address without the Street, Road, Drive, or Lane in the property address search cell.

Try entering only the first letter for directional identifiers like N for North, E for East, S for South, W for West

Example Address: 1234 West 32nd Street

Search by 1234 W (do not type out West) and scroll down to find your street name.

Search by 1234 W 32nd (do not enter Street or St.) and you should go directly to your property address.

Service Fees

All payments processed on-line will be assessed a service fee. The Treasurer-Tax Collector's office does not charge a fee to process payments on-line, however, the vendor processing your payments assesses the service fees. All service fees are assessed by our credit card vendor, not the County.